Jamie Mai’s net worth in 2026 reflects the disciplined ascent of a contrarian hedge fund strategist. His career gained global attention after The Big Short highlighted Cornwall Capital’s early bet against the subprime housing market. As CEO and CIO of Cornwall Capital, he continues applying asymmetric investing and precise risk control to build long-term wealth.

His journey shows how patience and foresight shape financial success. Starting with a small fund, Jamie Mai expanded Cornwall Capital through overlooked opportunities and steady performance. In 2026, his wealth remains closely tied to the firm’s growth and consistent investment strategy. His story highlights disciplined investing rather than hype-driven finance.

Introduction to Jamie Mai’s Financial Journey

Jamie Mai’s journey to financial success is both fascinating and inspiring. Born in New York, he started his career with a strong foundation in economics and finance. Jamie Mai’s financial journey began when he co-founded Cornwall Capital, shaping his future. His ability to see market inefficiencies and take risks led him to become a financial pioneer.

He gained fame for capitalizing on the subprime mortgage crisis in The Big Short. Through his strategic investments and sharp market insights, Jamie Mai became a well-known figure in the investment world. His visionary leadership and bold risks have been key to his career and net worth growth.

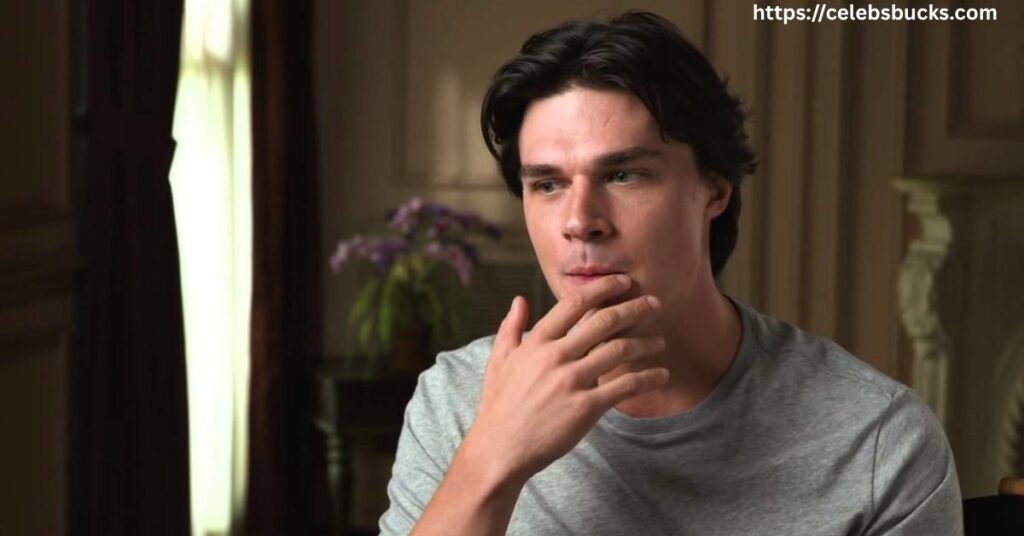

Who is Jamie Mai?

Jamie Mai is a financial expert and the co-founder of Cornwall Capital. His rise to fame came after The Big Short movie. In the film, his role in predicting the subprime mortgage crisis stood out. Born into a family with strong private-equity roots, his father, Vincent Mai, led AEA Investors. AEA Investors stands as one of America’s oldest leveraged buyout firms. This early exposure shaped Jamie Mai’s understanding of capital markets.

He identifies financial trends early, marking his career. This skill helped him achieve remarkable financial growth. Jamie Mai believes in radical transparency and contrarian thinking. These beliefs distinguish him from other investors. His unique investment philosophy focuses on finding opportunities where others see risks. This philosophy drives the success of Cornwall Capital today.

Jamie Mai at a Glance

| Category | Details |

| Full Name | Jamie Mai |

| Professional Title | CEO, Chief Investment Officer, Founder of Cornwall Capital Management LP |

| Age | 35 years |

| Height | 5’9″ (175 cm) |

| Weight | 66 KG |

| Jamie Mai Net Worth | $5 Million USD (as of 2026) |

| Company | Cornwall Capital Management LP |

| Assets Under Management | $133 Million (2025) (latest available) |

| Company Growth Rate | 29.48% (2024-2025) |

| Notable Achievement | Key Figure in “The Big Short” Narrative |

| Industry | Financial Services, Investment Management |

| Specialization | Strategic Investments, Risk Management |

| Key Collaborators | Michael Lewis (Author of “The Big Short”) |

| Company Official Site | www.cornwallcapital.com |

| Company Headquarters | 1345 Avenue of the Americas, 2nd Floor, New York, NY 10105 |

Jamie Mai is in his mid-30s and continues leading Cornwall Capital’s investment strategy. His personal net worth remains closely linked to fund performance and leadership compensation. The firm has expanded steadily since its early years, attracting institutional attention after its Big Short success. This growth reflects Cornwall Capital’s disciplined focus on asymmetric opportunities and market inefficiencies.

Jamie Mai Net Worth in 2026

As of 2026, Jamie Mai’s net worth is estimated at around $5 million. This wealth comes from his leadership at Cornwall Capital and his personal investments. He built his fortune through disciplined investment strategy and expert risk management in the hedge fund industry.

His personal wealth remains closely linked to Cornwall Capital’s assets under management and hedge fund performance, estimated around $133 million in recent filings.

His wealth continues to grow alongside the firm’s performance. Cornwall Capital’s value increased from $13.5 million in 2022 to $22 million in 2024, reflecting strong annual growth rates. This steady expansion remains a key driver of Jamie Mai’s net worth growth and long-term financial stability.

Jamie Mai’s wealth structure relies mainly on hedge fund earnings, performance incentives, and investments tied to Cornwall Capital. The firm continues evolving across credit markets and alternative investments while maintaining its contrarian investment approach. This institutional positioning supports stable wealth accumulation rather than speculative growth.

Jamie Mai’s Yearly, Monthly, and Daily Income Breakdown

As of 2026, Jamie Mai maintains steady earnings from his role as CEO and Chief Investment Officer of Cornwall Capital. His estimated annual income is about $250,000, which equals roughly $21,000 per month and about $700 per day. These figures reflect his baseline compensation from hedge fund leadership and ongoing investment performance.

These earnings represent stable income from Cornwall Capital operations and long-term fund returns. In the hedge fund industry, a significant portion of leadership income often comes from carried interest and performance gains rather than fixed salary alone. Strong investment years can therefore increase total compensation beyond standard estimates.

Cornwall Capital’s continued success across financial technology, credit markets, and alternative investments supports Jamie Mai’s income stability and long-term wealth growth. The firm’s asymmetric investment strategy also means returns may occur in cycles rather than evenly each year, influencing annual earnings variation.

| Income Period | Amount |

|---|---|

| Annual Income | $250,000 |

| Monthly Income | $21,000 |

| Daily Income | $700 |

Cornwall Capital: Foundation of Success

Cornwall Capital has been the backbone of Jamie Mai’s financial success. Jamie Mai, Charlie Ledley, and Ben Hockett co-founded the firm. They built the company on bold and unconventional investment strategies. The firm’s notable investments during the subprime mortgage crisis helped its partners achieve remarkable returns.

Cornwall Capital stands out for its investment philosophy, which prioritizes radical transparency and contrarian thinking. This philosophy has allowed the firm to identify opportunities that others often overlook. These principles have played a key role in Jamie Mai’s financial journey. They have positioned the firm for sustained investment growth and resulted in consistent wealth growth.

The Big Short and Subprime Mortgage Crisis

The Big Short story shows how Jamie Mai and Charlie Ledley predicted the housing bubble collapse. They spotted massive problems in the subprime mortgage market before most Wall Street experts. Their foresight led to one of the most profitable trades in financial history.

Cornwall Capital purchased credit default swaps against subprime loans when others believed housing prices would never fall. This contrarian approach took great courage and conviction. The 2007-2008 financial crisis proved their analysis correct, generating huge profits while most hedge funds lost money. Michael Lewis captured their success in his bestselling book, The Big Short, making them famous worldwide.

Key Milestones in Jamie Mai’s Career

Jamie Mai’s career includes several remarkable achievements that established his reputation as a financial maverick. His transformation of $110,000 into $12 million during the early years of Cornwall Capital demonstrates his exceptional investment skills. This represents a more than 100-fold increase in capital through smart risk management and strategic thinking.

The subprime mortgage crisis trade remains his most famous success. Cornwall Capital earned $120 million from correctly predicting the housing market collapse. This single investment established their credibility and attracted new investors to their fund. The success led to Michael Lewis featuring them in The Big Short, bringing international recognition.

Cornwall Capital’s consistent growth from $13.5 Million in 2022 to $22 million in 2024 shows sustained excellence. The growth rates of 21.78%, 25.99%, and 29.48% over consecutive years prove their investment strategies work across different market conditions. This performance places them among the top hedge fund managers in America.

Leadership and Investment Philosophy

Jamie Mai’s leadership stands out for its vision and a sharp focus on risk management. He has always taken an unconventional approach. He prefers to think ahead of the curve, rather than follow the crowd. His investment philosophy revolves around asymmetric investments and identifying opportunities in market inefficiencies.

His financial principles shape how Cornwall Capital operates. He focuses on long-term value creation and environmental and social awareness. This ensures his firm’s investments are financially profitable and contribute to global economic restructuring.

Comprehensive Financial Growth: Jamie Mai’s Path to Success

Jamie Mai’s financial progression demonstrates how strategic investment and disciplined risk management create lasting wealth. His journey from $110,000 to managing a multi-million-dollar investment firm demonstrates disciplined capital growth and consistent investment returns. His long-term strategic capital allocation reflects expertise in the hedge fund industry. The investment company has grown consistently through bull markets and bear markets alike.

Cornwall Capital’s financial expansion reflects Jamie’s ability to adapt investment strategies to changing market conditions. The hedge fund has successfully navigated multiple economic cycles. These include the dot-com crash, the financial crisis, and the COVID-19 pandemic. Each challenge has strengthened their investment processes and risk management capabilities.

The fund’s economic advancement continues in 2026, with assets under management estimated around $133 million and expanding steadily. This investment growth represents steady progress in building a sustainable financial enterprise. Jamie’s leadership foresight has positioned Cornwall Capital for continued success in the evolving financial environment.

Factors Contributing to Jamie Mai’s Wealth

Several factors have contributed to Jamie Mai’s wealth. His deep understanding of investment strategies has been crucial to his financial success. He also excels at assessing and managing risk, which has further contributed to his success. Additionally, his firm’s investments in emerging economies and financial technologies have added significant value.

Through his investment philosophy, Jamie Mai has ensured that Cornwall Capital stays ahead of the competition. He leverages machine learning algorithms and blockchain technologies to optimize investments.

Collaborative Genius: Charlie Ledley and Ben Hockett

Charlie Ledley co-founded Cornwall Capital with Jamie Mai, bringing complementary skills and perspectives. Their partnership has been a driving force behind the fund’s success since 2003. Both share a contrarian mindset and a commitment to thorough research, which guides their investment decisions.

Ledley and Ben Hockett played crucial roles in building the foundation of Cornwall Capital. Their combined brilliance in strategic investment and market foresight continues to drive the firm’s success. Together, they lead Cornwall Capital into new financial frontiers.

Industry Recognition and Awards

Jamie Mai has earned recognition for his investment excellence. Michael Lewis featured him and Cornwall Capital in The Big Short. This exposure brought international attention to their strategies. It established Jamie as one of America’s top hedge fund leaders. Jack D. Schwager profiled Jamie in Hedge Fund Market Wizards. This placed him among the world’s top investment professionals.

Jamie’s investment philosophy and track record earned him respect from peers and experts. He is an influential figure in the hedge fund industry. His story and strategies have appeared in major financial books and articles. This media recognition boosted his credibility. It also attracted new investors to Cornwall Capital.

Personal Life and Family Support

Jamie Mai received initial financial support from his father, Vincent Mai. Vincent, a respected figure in private equity, also advises Cornwall Capital. Although Jamie’s personal life remains private, his family played a key role in founding Cornwall Capital. Their involvement helped shape the firm’s foundation and direction. They initially established the fund as a family office. This strong family involvement helped the fund grow and succeed.

The Pillar of Support: Jamie Mai’s Wife

Jamie Mai is married but keeps his wife’s identity private. She provides both personal and professional support, contributing to his success at Cornwall Capital and helping him navigate the demands of hedge fund leadership and long investment cycles. He maintains a clear separation between family life and public finance exposure, which explains the absence of public details or media presence. This privacy reflects his consistent low-profile investor identity.

Future Wealth Predictions and Outlook

Looking beyond 2026, Jamie Mai will likely continue growing his net worth as Cornwall Capital expands its investments and adapts to emerging markets. His wealth trajectory depends largely on the firm’s asset growth, performance fees, and successful trades. Continued focus on alternative investments, distressed credit, and niche financial opportunities could support gradual wealth expansion. Jamie Mai’s contrarian investment framework remains well suited to market dislocations and cyclical volatility, reinforcing long-term financial growth.

FAQs

What is Jamie Mai net worth in 2026?

Jamie Mai’s net worth in 2026 is estimated at about $5 million. It comes mainly from Cornwall Capital leadership income and investment performance.

Is Jamie Mai married?

Yes, Jamie Mai is married. He keeps his wife and family life private and away from public attention.

What is Jamie Mai’s role at Cornwall Capital?

Jamie Mai is the CEO and Chief Investment Officer of Cornwall Capital. He co-founded the hedge fund and directs its contrarian investment strategy.

What is Cornwall Capital Management LP?

Cornwall Capital Management LP is a financial firm. It focuses on innovative investment strategies.

What degrees does James A. Mai hold?

James A. Mai holds an undergraduate degree from Duke University. He also holds a graduate degree from The Leonard N Stern School of Business.

How did Jamie Mai initially build his wealth?

Jamie Mai started Cornwall Capital with $110,000 in 2003. He used contrarian thinking and risk management to grow it into millions.

What is Jamie Mai’s investment strategy?

Jamie Mai’s strategy focuses on contrarian thinking and market inefficiencies. He uses thorough research and disciplined risk management to ensure consistent returns.

Does Jamie Mai take risks with his investment approach?

Jamie Mai’s approach may seem risky. However, he focuses on asymmetric risk-reward opportunities with strong risk management for superior returns.

Who is James A. Mai?

James A. Mai is the founder of Cornwall Capital Management LP. He is the CEO and CIO of the firm since 2010.

When did James A. Mai become the CEO and CIO of Cornwall Capital?

James A. Mai became the CEO and CIO of Cornwall Capital in 2010.

Conclusion

Jamie Mai net worth in 2026 reflects disciplined investing and consistent hedge fund leadership. He built Cornwall Capital through contrarian thinking and strong risk management. His investment strategy targets asymmetric opportunities and long-term value. This approach created steady wealth growth across changing market cycles. His success highlights patience over speculation in modern financial markets.

Cornwall Capital remains the core driver of Jamie Mai net worth. The firm continues expanding across credit markets and alternative investments. His low-profile leadership style supports stable financial growth. Future expansion will likely follow fund performance and asset growth. Jamie Mai’s journey shows how disciplined strategy builds lasting wealth.

Emma Henry, an experienced blogger at Celebsbucks, specializes in delivering daily curated insights about celebrities and their net worth. Her engaging content keeps readers informed and entertained.